advance america cash

Q&A: Should i rating your state-recognized mortgage in new legislation?

A good ‘fresh start’ principle can be applied, which means folks who are divorced or ily family, or who’ve undergone insolvency process, might possibly be entitled to apply. Document photo: PA

The brand new legislation will make it more relaxing for men and women in order to take advantage of a state backed home loan getting another, second-hands or thinking-generate family.

An excellent ‘fresh start’ concept plus enforce for example individuals who try divorced or ily family, or that experienced insolvency procedures, is permitted apply as well as.

Homes Minister Darragh O’Brien keeps revealed a recently expanded regional expert mortgage design, enhancing the eligibility of those who can pertain

Financed by the authorities, financing is awarded via local government while the scheme try unlock so you can first time consumers – also to fresh start candidates – for the reduced otherwise more compact revenues just who cannot get sufficient funding out of commercial lenders buying the fresh new or second-hand characteristics or even to build her family.

A good. Besides being a primary-day customer – or becoming a unique Begin candidate – you really must be aged between 18 and you will 70, and also to have been in proceeded work to own a minimum of a couple of years, because top earner or be inside persisted a job having an excellent at least 12 months, due to the fact a holiday earner.

Due to Covid-19, this type of standards had been briefly informal, so you could still qualify for a loan in the event that there had been symptoms for which you just weren’t when you look at the continuous a position on account of Covid-19.

Although not, numerous relaxed work will never be felt eligible assuming your is self-functioning, needed a minimum of several full decades levels.

You also need to add proof decreased even offers from fund out-of a couple finance companies otherwise building communities, and you’ve got so you’re able to accept a keen Irish Credit Agency consider.

A beneficial. Homes ordered according to the program do not enjoys a regard excessively out-of 320,000 for the Dublin, Cork, Galway, Meath, Kildare, Louth and Kildare and you will 250,000 elsewhere. Solitary individuals dont enjoys income more than 65,000 in the event the seeking pick a property on the 320,000 domestic rate portion. The money roof having shared candidates is actually 75,000 all over the country.

A good. Whenever a beneficial 0.25% rate of interest protection into RIHL design finance (and you can upcoming funds within the installment loans Nashville yet ,-to-be-introduced LAHL scheme) are revealed last Sep, the Agency said that to own loans having regards to as much as 25 years, a predetermined rate of interest from 2.495% applied. And they mentioned that getting money which have terms of more 25 ages in order to three decades, a predetermined rate of interest away from 2.745% used.

The mortgage Protection Advanced (MPI) was at the amount of time 0.555%, bringing the every-in price of the home loan product to three.05% to own funds having regards to up to 25 years, and you may 3.3% for finance which have fund more 25 years or more to 30 decades.

A. The latest LAHL plan ‘s the new name on the Reconstructing Ireland mortgage (RIHL) plan it changes and it also comes into impression now

A. Maximum amount borrowed according to the RIHL is actually limited to ninety% of your own market price of the house otherwise, when it comes to thinking-make functions, 90% of the overall create costs. It indicates you should raise ten% from the tips and you will a minimum of 31% associated with put number was required to are from consistent and you will regular offers. A proven listing off book percentage are noticed the same out of protecting.

A. In dated RIHL plan, that’s supposed to be almost just like this new LAHL program, you can apply at several regional authority for folks who done an application form for each and every regional authority your used on and you can experience its app procedure. You can, although not, merely borrow you to definitely RIHL and also you needed to get otherwise care about-make a home in the local power urban area that you lent out-of.

Q. As it’s supported by the federal government, really does which means that a similar cautions on home loans throughout the individual market won’t very pertain here?

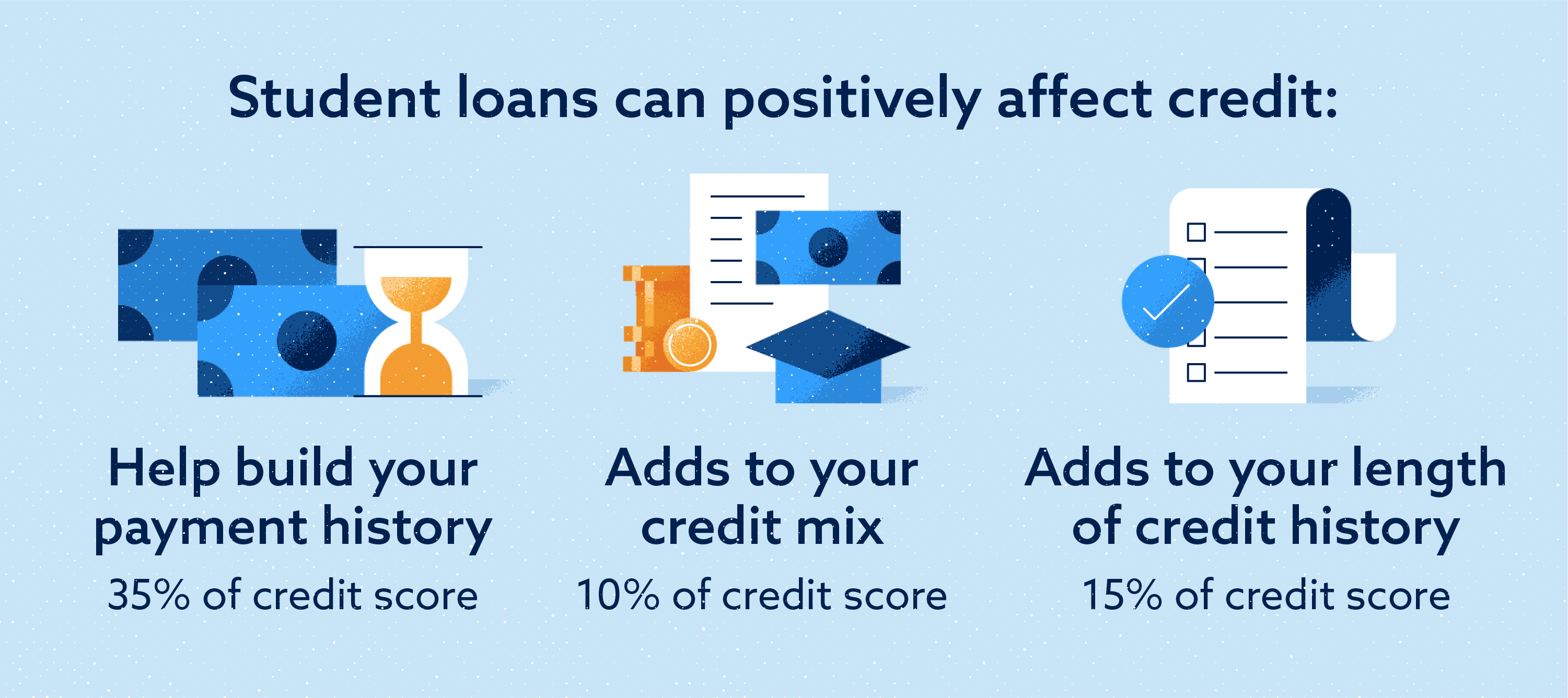

A great. No. An identical cautions apply. They range from the proven fact that If you do not carry on your instalments it is possible to eliminate your residence, the cost of their monthly money get improve and you may need to pay charge for folks who repay a fixed-price financing early. Put in one, if you don’t meet the repayments on your own mortgage, your bank account goes towards the arrears hence make a difference your own credit history, which could restrict your ability to accessibility borrowing from the bank in the future.