what is a cash advance loan?

Making homeownership inexpensive, you to definitely option you may envision are a multiple candidate home loan

- Specialist Blogs

- First time Customers

While you are Uk financial business could have started loosening their credit requirements pursuing the cutbacks within the 2020, that of your own matter is the fact taking home financing merely isn’t as easy as it used to be.

And also make homeownership inexpensive, one choice you may thought is a simultaneous candidate home loan. Although trickier to come by, with the aid of a broker its certainly something to talk about when you find yourself looking to get a base for the steps.

This guide demonstrates to you the benefits and downsides out of multi-applicant mortgages, how-to go about seeking one, and you can exactly what choice you can believe.

What is actually a multiple-applicant home loan?

A multiple-candidate or multiple-person’ mortgage are a home loan that is mutual ranging from more two different people. Everyone could well be titled into the possessions deeds and everybody would-be as one liable for the borrowed funds money.

That will get a parallel candidate home loan?

Anybody can get a multi-applicant home loan – although it is best to take advice from a broker which means you understand and this lenders promote these items.

Just like any mortgage, most of the functions inside it should satisfy financial requirements, as there are a threat of rejection if you or you to definitely or maybe more of the co-people has actually bad credit, affordability affairs otherwise tend to go beyond the most years limit inside home loan label.

There are not any restrictions to your who you could possibly get a multi-candidate home loan that have, whether it be a partner, household members, loved ones, if you don’t business couples.

However, it is important to think twice ahead of stepping into a contract given that there is certainly significant ramifications on your own financial upcoming.

Exactly how many anyone are going to be named towards home financing?

4 is usually the limit quantity of candidates, but criteria vary because of the bank. Some may only be willing to undertake more than several candidates when they bloodstream family unit members, or there may be most other stipulations connected.

When you find yourself obtaining a multiple-applicant home loan on intention from enhancing your affordability, be aware that even though some loan providers are content having several visitors to feel called to your label deeds, they could restriction what amount of candidates whose income represents to have cost objectives.

How do multiple-applicant mortgages range from important mortgage loans?

Usually, multi-person home loan prices and fees are like that an effective practical financial. However, having several people towards deeds allows you to mix their discounts and put off a much bigger put, that can seriously impact the cost you’re offered.

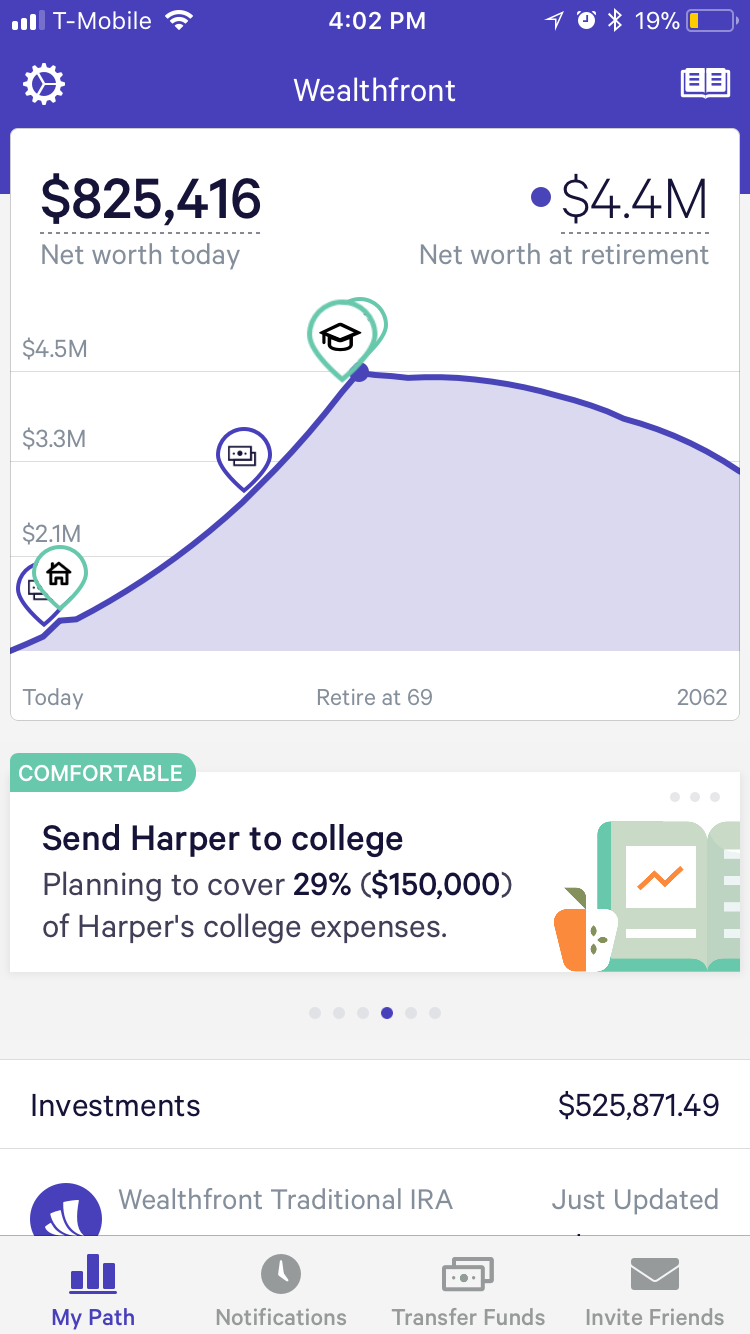

The bigger your own put, the greater amount of aggressive the brand new pricing shall be. Such, for individuals who cut good 15% deposit and one candidate preserves ten%, you’ll need a 75% LTV (Financing to help you Really worth) home loan. This needs to be relatively cheaper than the latest 85% LTV financial might was in fact in a position to pay for while the a single applicant.

The fresh new offers would be particularly tall to own very first-go out customers, in which using shared savings to move away from a great 95% to an effective ninety% LTV mortgage otherwise lower makes a big difference and you may rescue your thousands of pounds.

Exactly how much could you borrow for loans Our Town AL a multi-candidate home loan?

When deciding exactly how much you might borrow against a multi-person mortgage, of numerous loan providers will only check out the one or two large money earners and you can implement that loan cap according to a simultaneous of the shared wages.

That said, there are lenders online who will take all applicants’ money into consideration, however it is better to work at a brokerage to spot the best option bank, once the enhanced risk posed from the extra profits could imply highest costs.