payday loan leanders

HELOC Finance in the Tx: All you need to Know to help you Be considered

HELOC funds inside the Texas render home owners a flexible way to tap into their domestic security, governed of the collection of laws setting all of them other than HELOCs in other states. Property security credit line makes you borrow against the newest guarantee you’ve built up in your possessions, providing you with a great rotating personal line of credit the same as a credit credit.

Texas-Specific Guidelines

HELOCs in Texas was ruled because of the unique regulations which might be lay to shield customers and ensure in control credit strategies. Lower than is a detailed examination of the Texas-particular regulations having HELOCs and what you need to termed as a resident:

- Loan-to-Value Ratio: For the Colorado, residents normally borrow to 80 per cent of their house’s appraised well worth, including the present financial harmony. Such as for example, if the house is worth $300,000 and also you owe $150,000, you could potentially borrow a supplementary $90,000 due to a HELOC?. That it rules implies that property owners look after a substantial guarantee share for the their property, ergo lowering the danger of property foreclosure.

- Number 1 Home Needs: During the Texas, you could potentially only take HELOC loans at the number one quarters, and that means you won’t qualify if you want to borrow cash for the a second house or investment property??.

- Single Loan Code: Tx legislation enables you to only have you to definitely family guarantee financing or line of credit at once. Therefore, immediately following acquiring a beneficial HELOC for the Texas, you have got to hold off no less than one year before taking away another type of financing otherwise refinancing??. Which controls protects homeowners away from excessively borrowing up against their residence equity.

- Minimum Mark: Whenever beginning a HELOC, the original mark must be at least $4,000. That it regulation lets borrowers to access a hefty portion of their available credit upfront, promoting in charge borrowing from the bank. In addition suppresses lenders away from issuing credit lines getting minimal amounts, that may trigger unnecessary economic issue.

Eligibility Standards having HELOC Funds inside Texas

Tx, known for their book possessions statutes, provides particular qualifications requirements and you may laws and regulations getting HELOCs. If you’re a colorado homeowner considering a great HELOC, its required to see these conditions to make sure a flaccid app process in order to generate informed economic choices. Is a report on all you have to meet the requirements:

Credit history

Good credit is vital to have qualifying for HELOC loans inside Tx. Really loan providers usually imagine the absolute minimum credit score off 620, but you’ll more than likely get a good interest that have a higher score. Go with a credit history from 700 to change your chances? and safe finest conditions.

House Collateral

You really need to have large guarantee of your home so you can be eligible for HELOC money for the Colorado. Within this state, loan providers typically enable it to be residents so you’re able to obtain doing 80 % away from their house’s really worth without count it owe on the home loan. For example, if for example the house is worthy of $three hundred,000 therefore owe $150,000, you might use doing $ninety,000 as a consequence of good HELOC?.

Money and Employment

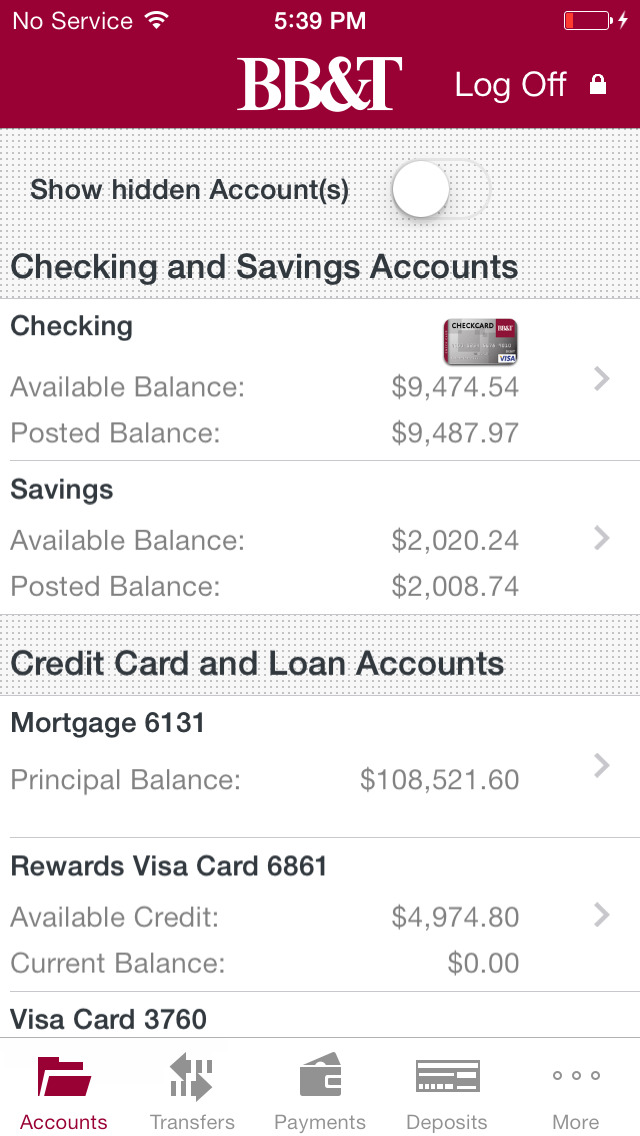

Stable money and you may employment records are very important in order to protecting an excellent HELOC. Loan providers will assess your capability to settle of the investigating your revenue, a job condition, and you will a position record. You have got to bring evidence of money, like shell out stubs, taxation statements, and financial comments?, showing that one can pay-off the fresh HELOC.

Debt-to-Earnings Ratio (DTI)

A unique crucial basis is your DTI proportion. Good DTI proportion compares your month-to-month obligations money towards terrible monthly earnings loans Gales Ferry. Of numerous loan providers choose a good DTI regarding 43% otherwise straight down. A lower life expectancy DTI demonstrates that you really have a manageable level of personal debt in line with your earnings, causing you to a glamorous candidate for an effective HELOC?.

Benefits of RenoFi Money

When you are a vintage ninety% LTV HELOC may seem such as a viable choice to fund good family restoration investment, they have a tendency to doesn’t work as readily available security isn’t enough to handle your wishlist. One good way to resolve that is to take into account new Shortly after Restoration Property value your home and rehearse you to definitely to increase the new offered collateral – here’s what RenoFi money carry out.