get payday cash advance

Exactly what are the positives and negatives of standard home financing?

Less updates and you will improvements: This type of house are not going to have a similar modifications and you may other choices one a traditional domestic really does. This can help to reduce down on some of the will cost you might sustain.

Upon careful review of these types of benefits and drawbacks, a standard family framework loan are precisely the version of financial support you should make a modular household

Much easier homes laws and regulations: When you find yourself you’ll find statutes that help book the modular house, they could be basic plus don’t feature normally variation since you may find with old-fashioned house.

While you are strengthening a standard family, many financial institutions will use a variety of framework-to-permanent investment. Such funds can be found in one or two degree. First, since the standard house is being depending, you might is only going to be required to build appeal-only money into projected price of the very last cost of the house. 2nd, once the house is done, an assessment are required to select the latest worth of the new modular household. Because the worth is decided, then your financing can become a typical home loan. This will be a common technique for investment the building regarding a great standard house, however, you will find several advantages and disadvantages you should know off.

- Only pay desire throughout construction: Within the construction of your standard loan, youre only expected to generate attract costs up to framework was complete. The reduced monthly payments are a great chance to cut back some money to pay for flow-inside costs, pick chairs, and create upwards a rainy big date finance.

- Versatile terminology: Even in the event a modular home build mortgage observe an installment agenda that have milestones additionally the lender will want to select intricate agreements of the endeavor, the regards to the mortgage themselves are actually some versatile when as compared to conventional mortgages.

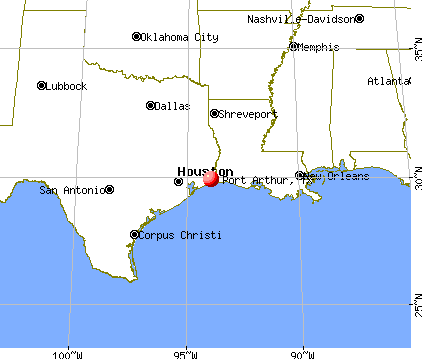

- A different gang of sight: When you yourself have the financial institution involved in reviewing your arrangements and you can inspecting the https://clickcashadvance.com/payday-loans-la/ development at each milestone, you will find a unique band of vision watching the task from the general contractor to be sure quality.

- Highest barrier to help you admission: By independence of a property-to-permanent mortgage, lenders might need high minimal criteria in order to meet the requirements. Typical lenders want the very least credit history regarding 680 and you can an effective minimum deposit away from 20% in order to be eligible for a standard household construction mortgage.

- Highest monthly obligations: Standard structure financing often require high monthly payments than simply a normal 30-seasons home loan.

- Highest interest levels: Standard framework loans commonly include a top interest rate than a traditional 30-season financial.

Basically, it is cheaper buying a modular family than to generate property. An average difference in price ranges out of 10% to help you 15%. The main reason for this speed variation is that standard residential property which might be pre-oriented, is going to be pre-built in industrial facilities where organizations should buy offers in large quantities, preserving costs into the materials. Plus, new assembly-line nature away from standard domestic structure can help to save money into labor also it prevents time waits because of environment or other unforeseen incidents. Big date waits can be costly should you be creating any form of home.

What is the difference in a standard house and a manufactured house?

A portion of the difference in modular belongings and you can are manufactured belongings throughout the eyes of your bodies is the jurisdiction of building codes. Standard property must stay glued to an identical local, state, and local strengthening rules which might be necessary for towards the-website land, if you’re are created belongings need to stay glued to government building codes. Another main disimilarity ranging from modular and you can are built house is the fact modular residential property features their portion built to a plant and then people parts is actually shipped out over the building website in which it is actually built onto a foundation. A made household has got the entire framework techniques completed in new warehouse following is sold as a whole equipment.