payday loans what is

Benefits and drawbacks away from USDA refinance financing

Cash-out re-finance

To tap your property equity, you’ll likely need to re-finance of good USDA mortgage so you can good traditional one. You want no less than an effective 620 credit score and more than 20% guarantee to help make the bucks-out refi worthwhile.

Homeowners having credit less than 620 but over 20 percent security might use the newest FHA dollars-aside mortgage. But be cautioned one to FHA financing have high upfront and you may yearly mortgage insurance costs than simply USDA fund. So that your costs could actually raise.

Refinancing USDA re-finance fund should be sensible, particularly if all you need is a lower rates and you can commission.

Gurus away from USDA re-finance funds:

- Streamlined Refinancing choices are generally smaller, simpler, and you can less expensive than a classic refinance

- Zero the brand new assessment getting a sleek Re-finance means there is no need one home equity to help you qualify

- USDA’s upfront guarantee fee is actually cheaper than FHA’s upfront mortgage insurance; USDA’s yearly costs is actually straight down, as well

- USDA fund usually have straight down interest levels than simply conventional finance

- You could potentially re-finance an excellent USDA mortgage when you’re underwater, meaning you owe more than the worth of your residence

- A leading personal debt-to-money proportion and you will reasonable credit score actually an issue with a good USDA Sleek-Let Re-finance

- That have USDA refinance financing, you might move settlement costs into the the new financing equilibrium and you may cure so it aside-of-wallet expenses

Drawbacks out-of USDA re-finance finance:

- You can not cash-out your home equity

- You simply can’t reduce the loan identity; you could potentially merely prefer a thirty-year, fixed-price loan having good USDA re-finance

I became advised I am unable to re-finance my personal USDA loan?

For just one, the lender only will most likely not promote USDA lenders. Not totally all lenders carry out, thus you will have to comparison shop for one one to https://speedycashloan.net/payday-loans-mn/ does.

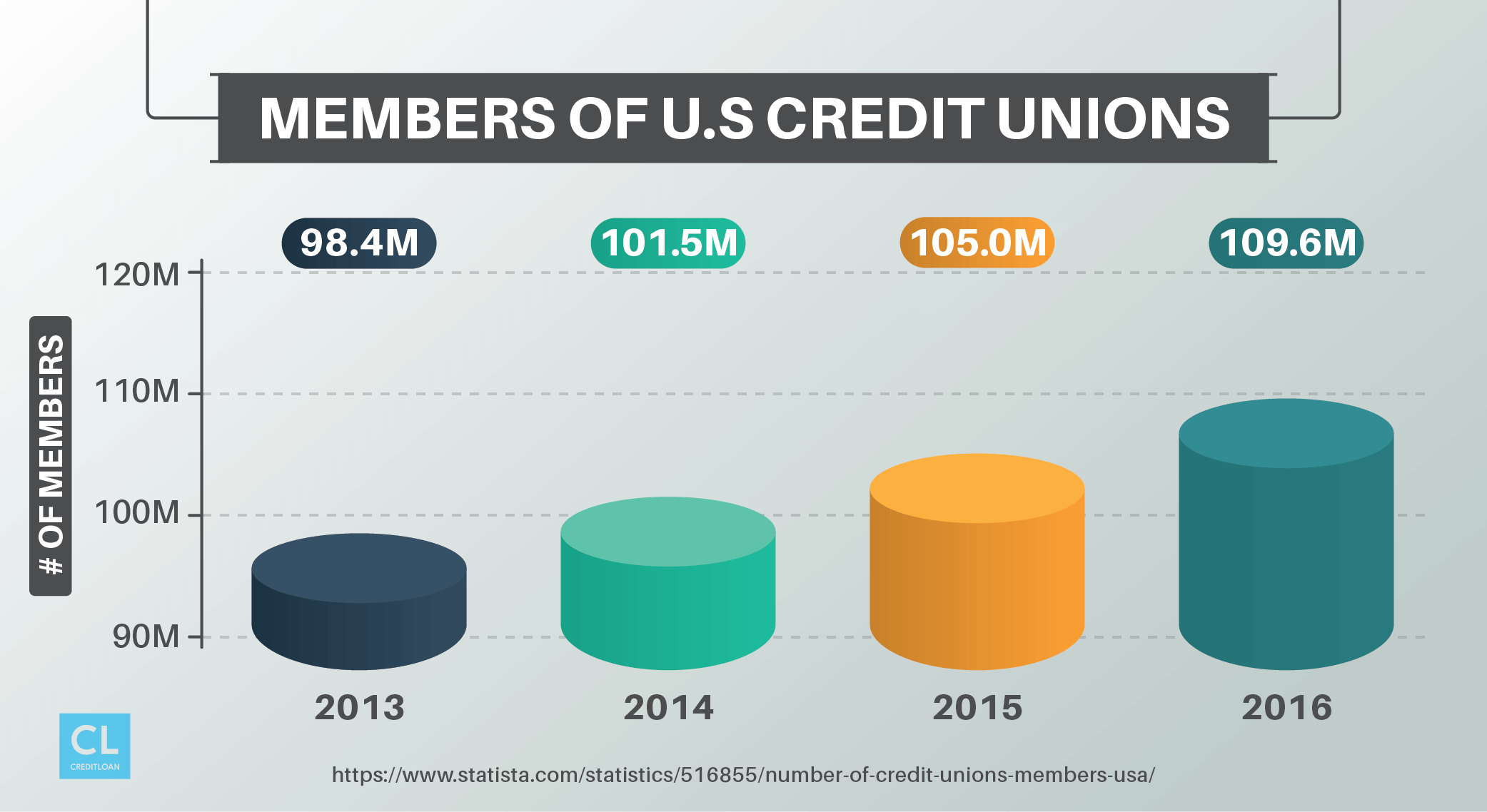

Fortunately that you will not need lookup much. Of numerous banking institutions, credit unions, financial organizations, and online loan providers is actually approved so you’re able to originate these types of funds across the country.

If you meet the requirements to own an effective USDA home mortgage refinance loan but a lender denies your, try again which have a special providers.

Such, a lender you’ll reject the Smooth Refinance in the event the mortgage try lower than 12 months old or you haven’t produced costs to the go out.

Speak with the financial institution to find out the specific situation. If you cannot refinance now, you are eligible next 6 to one year.

For those who meet the requirements mentioned above but a lender still rejects your own re-finance, are again with another type of financial.

Mortgage businesses can also be place their particular credit standards, and if you’re investigating the way to get off an excellent USDA mortgage, there is a go the thing is that you to definitely ready to re-finance your own financial whilst earliest financial your spoke that have won’t.

Refinance USDA loan FAQ

While you are refinancing an effective USDA financing to another USDA loan, your existing mortgage generally speaking must be no less than 1 year dated (that have on-date costs for the past six months). If you want to refinance USDA loan to help you a normal, you may be capable re-finance immediately. Yet not, you will likely you would like a minimum of 3 percent collateral regarding house. So you might need to hold off to refinance for individuals who got advantage of USDA’s no-down-percentage allocation.

USDA funds lack private home loan insurance rates otherwise PMI.’ But individuals possess a yearly USDA verify fee (paid-in monthly premiums) one to will act as home loan insurance policies. It fee lasts for the life from a USDA loan. Because house provides about 20% guarantee, you will be able to refinance their USDA financing to good conventional loan and then have rid of their financial insurance coverage.