quickloan payday loan

Arvest Lender Lending company Reputation: Chris Barlow

Ranked as the Zero. 1 one of GOBankingRates’ Greatest Regional Banks of 2023, Arvest Bank assists reveal customers the way in which household using their exclusive profile regarding lending products and qualities.

The newest Ancient greek language philosopher Aristotle used to be cited because stating, Brand new substance away from life is so you’re able to serve others and you can do good. The newest banking experts within Arvest Bank appear to had brand new memo, as the attributes they give the communities are typically within the classification and therefore are constructed with a consumer-centric therapy. That have a keen concentrate on the buyers, Arvest Financial increased regarding a small bank more half dozen decades ago toward a residential area-engaged regional lender that provides a huge array of a good financial properties. With well over 200 banking locations that is part of fourteen locally addressed banking institutions in more than simply 110 teams, Arvest Financial stands as the a respected chief throughout the banking industry. That is mainly due partly towards the positives employed by Arvest Financial which direct with an effective servant’s cardiovascular system and you can bring to the brand new table a great deal of industry knowledge and experience.

Chris Barlow, Home loan company with Arvest Financial, NMLS#327550, possess a robust background in the mortgage financing stadium. Though relatively a new comer to Arvest, he’s almost twenty five years of experience in the industry. He began his career as the a little representative and very quickly been his personal mortgage lender.

This is the largest reading curve for my situation, emphasized Barlow, just who in the course of time increased in order to five metropolitan areas round the five claims in the very early 2000s. Just like the some thing began to change in a, Barlow’s dreams to take their community to some other top was to the full throttle. He offered his organization following struggled to obtain almost every other national monetary institutions, and that established the doorway so you’re able to their welfare.

As such, previously decade, Barlow worked having brand new home consumers, helping all of them result in the ideal choices with respect to their resource.

A look into the present Family Industry

Barlow expressed the newest and existing family sales , generally considering the rise in interest rates at the time. Yet not, with regards to the Kanas City Local Connection away from Real estate agents Heartland Multiple listing service, Barlow detailed one to when you look at the 2022, there were 36,769 present household transformation and you can step 3,549 new house conversion process.

Of a positive development perspective, the typical prices away from residential property have gone right up online personal loans Wisconsin 15%-16% year after year over the last 24 months, having the average present family price of $300,000 and you will the average brand new home cost of $558,000 at the end of 2022, Barlow expressed. There’s a consult for new homes and therefore value of land will still be staying solid, which is a significant piece of industry. Following the first rate plunge in the last one year, consumers be seemingly acknowledging the rise when you look at the pricing plus the the brand new normal for the moment.

From the Arvest Bank, we provide an entire monetary bundle, said Barlow. To that particular end, they can help consumers that have one to significant material impacting consumers now: credit card debt.

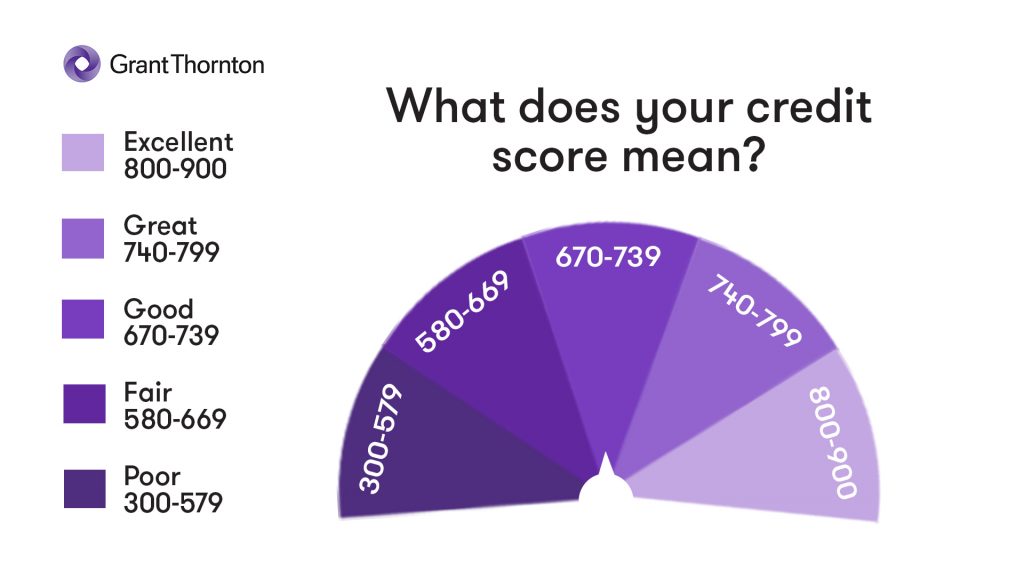

Credit card debt ‘s the largest it’s been into the 20 many years, he highlighted. The complete house obligations on U.S. achieved $ trillion about 3rd quarter out-of 2022. Your debt weight, if regarding car loans, non-secure loans, playing cards, and college loans, particularly, makes it and that means you cannot afford purchasing property.

Depending on the Federal Set aside Lender of the latest York, this new 15% year-over-12 months boost in home credit card stability was higher than they has been in during the last 20 years. Indeed, non-casing loans harmony grew of the an astounding $66 mil.

Barlow subsequent explained that loan stability about credit cards, mortgage loans and you may auto loans remained increasing on 3rd one-fourth out of last year, which shows improved user request and higher cost. Yet not, this new real estate loan originations have lost some of the earlier traction and also modified to pre-pandemic account inspite of the increase in interest levels.

Debt consolidation try an approach Arvest will need with people whenever requisite. Through providing personal lines of credit, Arvest will help customers eradicate their monthly paying making they reasonable buying a home.

The beauty of this might be which exist the debt down, obtain the domestic, refinance if wanted*, along with your overall financial predicament are still ideal, Barlow said.

A financial drugs getting doctors

Exercising doctors qualify individuals to the home loan into the-home physician system provided by Arvest Lender, and that talks of a health care provider as all after the:

You can expect 100% financing** having certified doctors up to $1.25mm, in addition they might even money regarding settlement costs in a few circumstances. With just 5% off, we are able to give doing $step one.75mm having certified borrowers. These financing lack month-to-month financial insurance, which helps contain the monthly payment down.

In order to do it, Arvest lovers users which have Personal Lenders which advice about the financial elements, besides mortgage loans.

We set users with a private Banker exactly who helps them navigate its month-to-month expenses, the guy mentioned. I and additionally assist with commercial fund, for example having a private habit.

The latest construction hopes and dreams

Barlow’s number 1 attention is found on the new build, dealing with each other designers and customers strengthening property, in addition to which have antique mortgage loans.

We offer prolonged speed locks into the fresh structure, to 3 hundred days on conventional Case and you may repaired-rates loans, and additionally Jumbo Case funds, he told you.

Barlow provides delivering really involved in the processes, also, guaranteeing the new structure is perhaps all finished in a timely fashion. To this avoid, the guy runs each week appointments that have users and holds lingering and you may comprehensive correspondence regarding build techniques with the creator, new Real estate agents, and the consumers.

Connecting with individuals to own lasting matchmaking and you may helping customers using their financial situation is inside an effective day’s work to own Barlow, however it is not at all something the guy requires gently.

I thoroughly take advantage of the entire process when making use of consumers whom come in the process of getting its dream domestic, smiled Barlow. I carry out pressure one to goes with they and will assist all of them pick financing system that suits their finances need.

Conclusion

Even with their impressive growth just like the the very humble beginnings, Arvest Lender can’t ever waver from its dedication to sit correct in order to their principles and means you to definitely stand at its foundation. Getting the needs of the customer basic try their top objective. Anyone enabling anyone pick financial options forever is really what it carry out most useful.

* Funding is obtainable to own certified people predicated on money and you can credit certification. Having fun with domestic security to pay off low-mortgage financial obligation you will definitely boost monthly home loan repayments whenever you are lowering the number of any percentage you to would go to prominent. The entire you pay four weeks into the obligations you’ll decrease, whether or not a higher personal debt harmony manage today be tied to the family, probably to possess an extended identity. For your certain condition, get in touch with home financing pro.