cash advance payday loans

To shop for good Duplex or Multifamily Family when you look at the The latest Hampshire

To purchase a good multifamily assets can be a money having desirable production, and you may multifamily money is not much different from an elementary mortgage. Listed below are all of our best four incentives:

- Increase your advantage collection Purchasing several properties needs time to work & most currency. Committing to multifamily housing nets your multiple property in one transaction.

- Make inactive income Reliable tenants create lease range a breeze. If you normally invest in assets repairs, renter help and you can candidate tests, multifamily homeownership almost will pay for itself. Know the loan whether or not: Ensure that the terms of your own home loan allows you to shell out with rental money.

- The fresh new timing excellent Investing an effective duplex or multifamily house is an appealing solution to have more youthful otherwise unmarried customers seeking build their advantage portfolio. I encourage starting with a proprietor-filled property, following turning it with the a residential property a couple of years off the latest line.

- Decrease your life style can cost you As well as event rent, cost to own multifamily loans do not have a tendency to improve over the years doing the individuals to own single-family house. Best of all, you are capable write off household repairs since team expenditures!

Multifamily Real estate loan Conditions

Quite often for the The newest Hampshire, functions having 2 to 4 ily services. One thing with four or maybe more products is regarded as a commercial assets, and sells entirely various other financing conditions. Opinion this number to see if your property is qualify for good multifamily mortgage.

- two to four independent products (duplex, triplex, quadplex, townhouse, reily household or semi-detached domestic)

- For each product has its own home, toilet, access (usually) and you may target/equipment matter

- Capacity to become proprietor-filled for at least 1 year (FHA otherwise Virtual assistant funds simply)

You can make use of each other latest and estimated (future) rental earnings so you can be eligible for FHA and you may conventional finance, so long as the money was properly recorded and/otherwise rightly modified to own market book cost

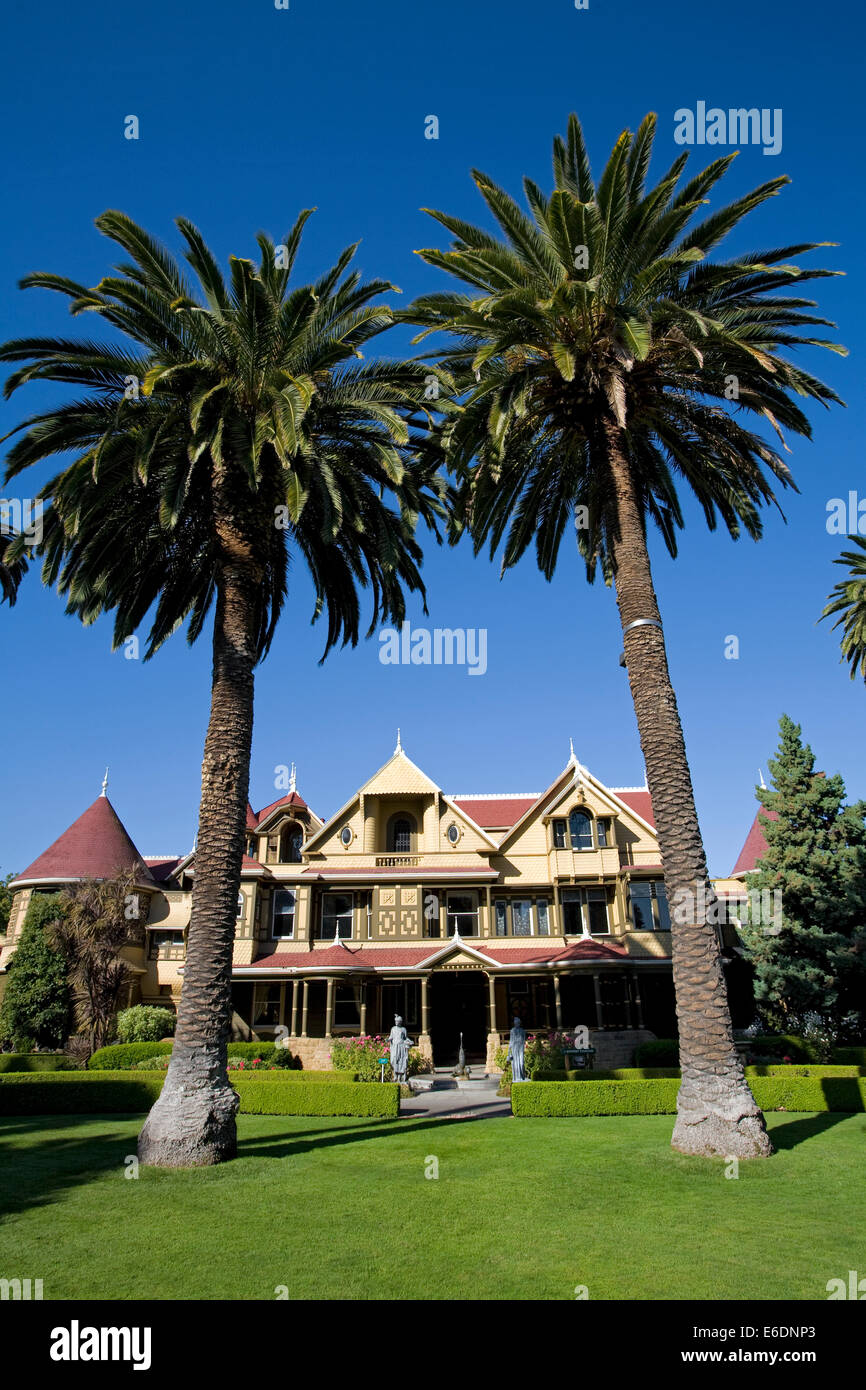

With its historical locations and you can scenic college urban centers, The fresh Hampshire brings plenty of multifamily possessions choice, of translated mill property to help you stately Victorian land. Durham, Keene and you may Haily attributes, as a result of the longtime annual increase regarding people and you can faculty seeking to construction. As well, towns and cities like Portsmouth and you will Manchester, whilst not cities towards the par having Boston, home their great amount of working pros, younger clients and you will residential district flat-dwellers.

Even though some of one’s state’s more mature property pshire Casing also offers as very much like cuatro% for the bucks direction beforehand in order to counterbalance closing costs. Make sure to do your research whether or not: Loan limits are very different one state to another and you will state so you can state. Fortunately, new Stone State provides rules in place to safeguard the customer out-of unforeseen charges.

If you’re considering investing in a great multifamily possessions during the The newest Hampshire, Blue water Financial has all of the answers you ought to initiate examining the options. E mail us today.

Q: Can you use leasing money in order to be eligible for financing? A: Yes, but with criteria. But not, that isn’t anticipate under an excellent Virtual assistant financing.

Q: Exactly what leasing money seeking to help you qualify for a loan? A: Whenever trying to get a keen FHA or traditional loan, you could matter 75% of read what he said the local rental earnings away from a house you already individual, or the rent you expect to receive from the next possessions. This relates to the business book regarding each other proprietor-filled and you will capital characteristics.

Q: How much cash do you want from inside the reserves to qualify for a good mortgage? A: In addition to your settlement costs and charges, make an effort to establish you have got sufficient money left over to put your mortgage lender relaxed, in case there is a loss of income. Based the loan sort of, you could potentially you would like anywhere from 3 to 6 months’ property value home loan repayments inside liquid bucks – possessions just like your vehicle or other qualities dont matter.