how much can i get payday loan

First of all, he has got an equal obligation in making certain that the newest costs is made

Having cost of characteristics to get unaffordable in the sought after metropolises, moms and dads was stepping directly into let the children get on the new assets hierarchy. Probably one of the most popular way these are typically assisting is through as a great guarantor utilizing the guarantee in their property as well as on rare instances, by being joint individuals.

Whenever you are guarantors are generally used to help borrowers end lenders financial insurance policies (LMI) premium, combined individuals assistance to brand new maintenance of your financing rather than new guarantors Fairfield same day loan. A borrower in addition to their mate/ lover generally speaking act as joint consumers and you will finance companies typically merely ensure it is good borrower’s instantaneous members of the family is good guarantor.

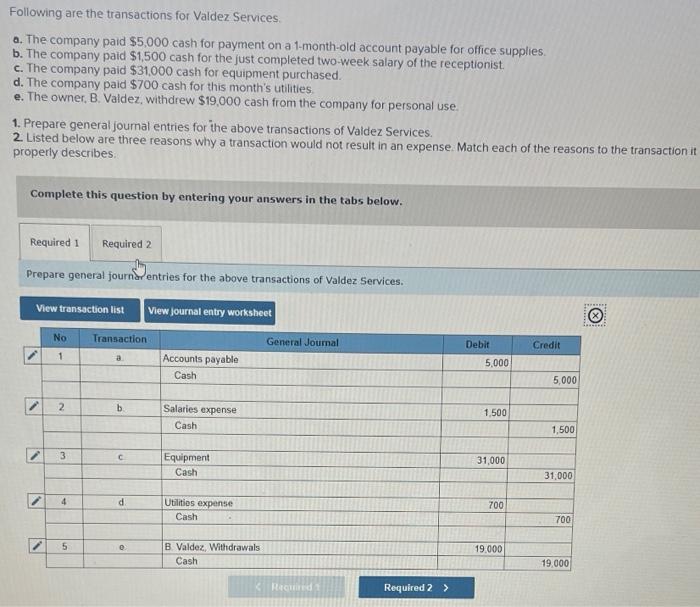

Joint Borrower

The best way to think of a joint borrower was people that will co-own the house or property that have every other individual for the loan application. Combined consumers suppose the same portion of the mortgage liability just like the the prie seems for the every mortgage data in addition they are inserted towards title.

Its generally knew that joint debtor was contributing into the borrowed funds payments in addition to their income and you can/or assets can assist for the financing serviceability.

Shared individuals usually have equivalent legal rights (joint renters) for the assets, regardless if they’re able to and individual a share regarding possessions (renters in keeping with only 2 owners). In which there are two or more citizens (renters in keeping), a borrower can be very own just 1% off a property, depending on the collateral contribution of every shareholder.

A shared debtor could probably allege any tax advantages of a good investment home loan, including focus deduction, except if he is tenants in common, then simply commission equalling their express of your own attention costs will become claimable. Demand an authorized tax advisor to verify just what enforce on your individual case.

If the a joint-tenant holder passes away, the house or property ownership are transferred to the remainder class while when you look at the an excellent renter in common’ possession, only the display owned by passageway people transmits to his or their unique property.

New Guarantor

A great guarantor is utilized generally to aid number 1 borrower(s) stop expenses LMI, in this case an important debtor typically has money in order to hold the mortgage but may not have enough put so you can contribute on pick.

A guarantor does not have any the same possessions legal rights since the a combined debtor since their name is merely on home loan and not towards name of the home. The character is exactly to provide guarantee and so the financial count was lower than 80% of your own full worth of all bonds.

In place of a shared borrower, this new guarantor normally becomes responsible for standard just pursuing the financial has actually worn out all other a style of range from the number one debtor(s). It is important that the latest guarantor look for legal advice on the responsibility of any a good accountability if your borrower defaults.

Guarantors are typically in best financial position as compared to no. 1 borrower and, because they don’t own people stake about possessions getting bought, sometimes they assist away from compassion (we.elizabeth. a parent helping away a grownup youngster).

Very loan providers do not allow guarantor service unless of course the fresh new individuals are to shop for a first residence we.elizabeth. maybe not having investment property pick otherwise in which individuals would like to refinance and take cash out of their property

Loan providers allows minimal be sure getting put contrary to the guarantor defense, typically the ensure matter try not to meet or exceed a particular portion of the new guarantor’s value of.

Nearest and dearest vow, Household members verify and guarantor are some of the well-known terms and conditions used because of the different loan providers for the same product.

Points to consider

Promising a mortgage loan should never be taken softly, it is far from a lifestyle sentence however the guarantors have to consider all implications prior to agreeing to provide shelter make certain. Preferably, as number one debtor (s) has received a way to become more economically secure and you will centered guarantee within their property, every people is also consider refinancing the fresh new the financing to get rid of the fresh guarantor(s).

Remember there can be costs associated with so it. Their lender might consider it breaking the home loan when it is repaired and over just before readiness, in which case a penalty will get pertain. Therefore ensure that the terminology are obvious in the event the guarantor wants away early.