cash advance items

Do Portal Financial Are employed in My Urban area?

Portal Mortgage is a keen Oklahoma-based lender which is a subsidiary away from Portal Very first lender. The business even offers multiple home loan situations, and additionally repaired-price mortgages, adjustable-speed mortgages, FHA loans, Va funds and USDA fund. The firm and additionally operates in the most common of one’s You.S.

Gateway was named as one of Financial Manager Magazine’s Ideal 100 Mortgage Businesses in the U.S. from year to year between 2012 and you may 2019. Out of 2013 to 2019, the firm also seemed towards Inc. Magazine’s variety of new 5000 Quickest Expanding Private Companies.

Portal Home loan develop money from the adopting the 39 states and you may Arizona, D.C.: Alabama, Washington, Arkansas, California, Tx, Connecticut, Delaware, Florida, Idaho, Illinois, Indiana, Iowa, Ohio, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Las vegas, New jersey, New Mexico, Vermont, Kansas, Oklahoma, Oregon, Pennsylvania, Sc, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Western Virginia, Wisconsin and Wyoming.

What sort of Home loan Ought i Score Which have Portal Mortgage?

Fixed-rates home loan: This is actually the most well known particular financial readily available. A rate try closed within the at the beginning of the loan and will not changes. Portal also provides all of them with terms of anywhere between ten and 30 years.

Adjustable-rates home loan (ARM): With varying-rates financing, discover a fixed rate to possess a flat period of time, following the rate is sometimes adjusted. Portal also provides step 3/six, 5/6, 7/6 and you will 10/six money. The initial matter means the duration of new repaired-rates period, and half dozen designates that when the pricing was adjusted twice yearly.

Jumbo financing: This type of really works an identical suggests since the old-fashioned finance, but are having large amounts of currency. To have 2023, the newest restriction to possess a normal loan is $726,2 hundred in the most common of the country, although it may go as much as $step one,089,300 in a number of higher-rates parts of the country.

FHA Finance: FHA loans are available combination into Government Housing Management (FHA). They require only 3% downpayment and generally are offered loan places Stafford Springs to customers with reduced-than-sterling borrowing records.

Va finance: Virtual assistant finance arrive to the backing of the You.S. Pros Administration in order to veterans of one’s equipped services. There isn’t any downpayment requisite and rates are generally much better than which have traditional money, although there is actually good Virtual assistant capital percentage.

USDA financing: USDA money, developed by the latest Institution regarding Farming, need no downpayment and can end up being got that have a minimal credit score. He could be limited inside the appointed rural section, even though.

What can You will do On the web Having Gateway Financial?

You might sign up for that loan on the web that have Portal Mortgage, definition you will never need to use the situation of going with the a workplace to satisfy which have a home loan broker. You may also have fun with Gateways web site to autopay the loan. This makes it better to be sure to condition up to day on your own repayments.

Do you Be eligible for a home loan out of Portal Financial?

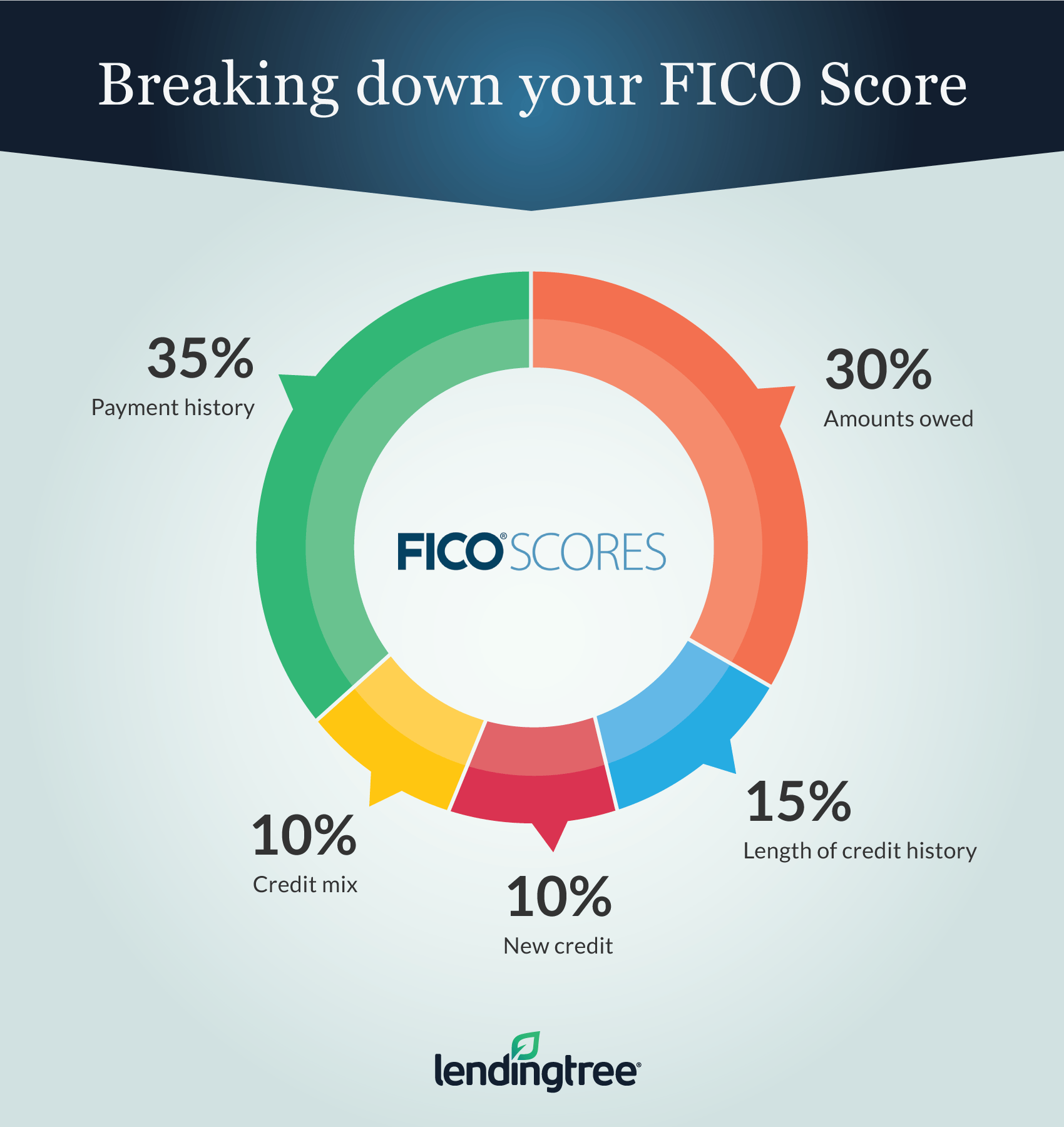

Portal cannot provide a specific minimum FICO score because of its mortgage loans. However, normally, a credit rating of at least 620 is needed to own a good antique financing, either repaired or changeable. Fund which have government support possess a lower life expectancy FICO score needs. By way of example, a keen FHA mortgage may only require the very least credit score away from 580.

To possess antique money, a down payment with a minimum of 3% is necessary, even though this could change towards the a customers-to-customers foundation. When you can muster upwards no less than 20% down, you simply will not you want personal mortgage insurance coverage (PMI), that is simple along the industry.

What’s the Procedure for finding a mortgage Which have Gateway Mortgage?

You could start the procedure by getting preapproved for a financial loan having fun with Gateway Mortgage’s site. You can publish all your valuable associated documents and you will Portal will see that which you be eligible for.

From that point, you will need to discover a house. After you have a house we need to purchase, you’ll bring your pre-acceptance and make an offer. The mortgage will go in order to an underwriter to own final approval. As soon as your loan is approved, possible intimate the newest product sales – also expenses relevant closing costs – as well as have your keys.

How Gateway Financial Rises

You should buy all the mortgage possibilities you’re looking for at Portal Financial, together with popular authorities-recognized applications. If you live in a condition in which Gateway operates, you may possibly be able to find what you’re finding.

Somewhat, Portal enjoys strong on the web units, such as the ability to get a loan and also make mortgage payments on the web. Many smaller lenders you should never give that it, very that is a major also to your company.