how do i get a payday loan with bad credit

Origination: Definition inside Financing, Financing Processes, and needs

Thomas J Catalano is actually an effective CFP and you may Inserted Financial support Agent with the state of Sc, where the guy released their own economic consultative enterprise in 2018. Thomas’ sense brings him expertise in multiple elements in addition to financial investments, old age, insurance policies, and you will economic planning.

What is Origination?

Origination is the multiple-step procedure that every person need to undergo discover good home loan otherwise home loan. The phrase and additionally pertains to other types of amortized personal loans. Origination is often a long procedure that try overseen from the Federal Put Insurance Company (FDIC) having conformity that have Term XIV of your Dodd-Frank Wall structure Road Reform and User Shelter Act. A loan origination fee, always throughout the 1% of loan, is meant to make up the financial institution to your functions involved in the method.

Trick Takeaways

- The origination techniques tend to relates to lots of steps which will be tracked from the FDIC.

- Pre-certification is the starting point of your origination techniques which can be when a loan officer get all first studies and you may recommendations related so you’re able to money as well as the possessions involved.

- Most of the documentation and you can files is actually up coming explain to you an automated underwriting system for loan recognition.

Exactly how Origination Functions

Finance assist customers and businesses satisfy its monetary wants and you will obligations. They’re regularly make large sales, pay financial obligation, commit, otherwise get properties including house. To become acknowledged, new debtor must submit an application for investment.

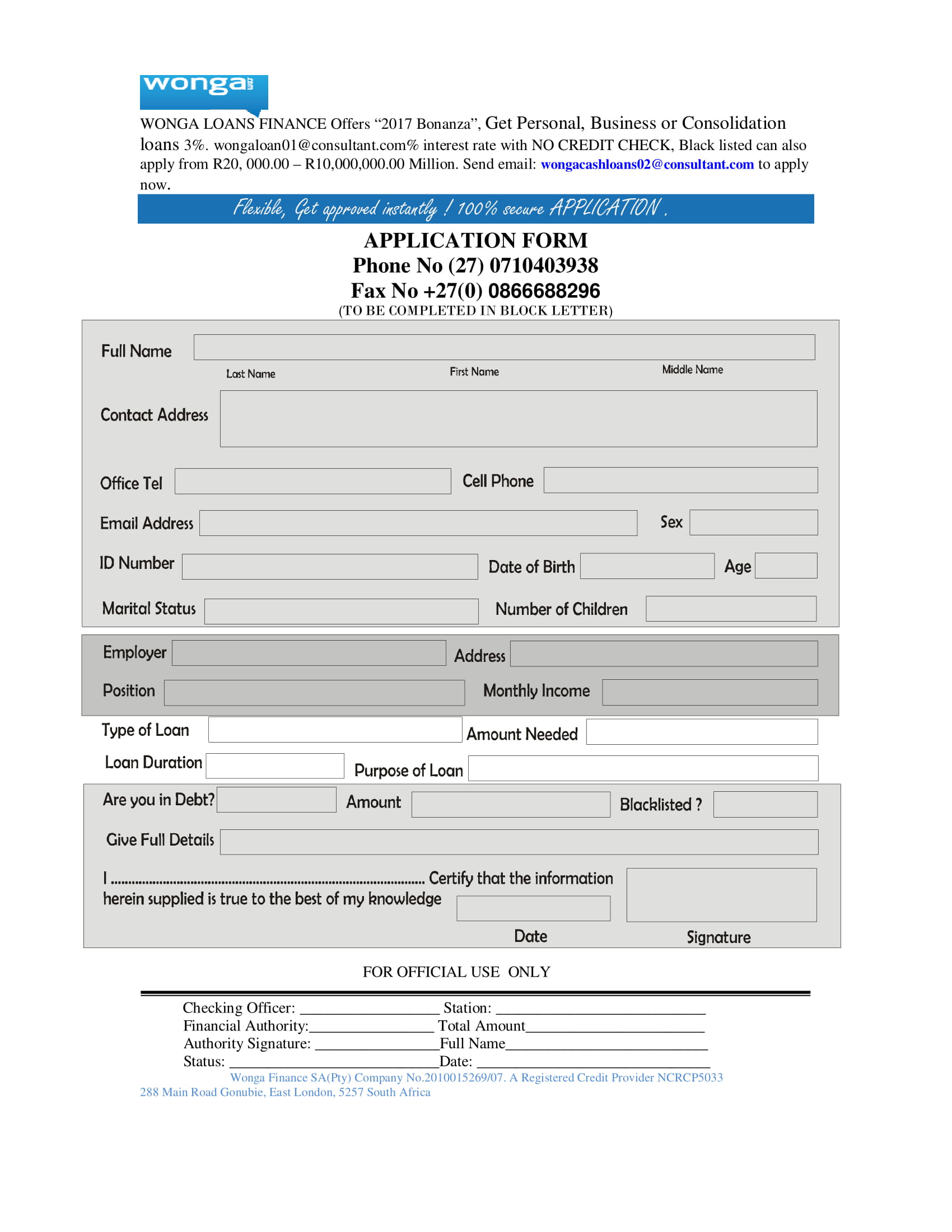

Borrowers have to fill out all sorts of economic advice and you can documents to the lending company or other lender into the origination techniques. Probably the most preferred variety of pointers and files called for include:

- Tax statements

- Commission records

- Credit card advice

- Lender statements and you will stability

Lenders next utilize this pointers to search for the type of mortgage therefore the interest in which the brand new borrower is eligible. Lenders in addition to have confidence in additional information, particularly the borrower’s credit report, to decide loan qualifications.

It isn’t strange having loan providers on the U.S. to help you costs origination charges. Talking about initial charges you to borrowers have to spend the money for bank while the compensation toward software, underwriting, and recognition process. Generally starting between 0.5% to a single% of the mortgage value, the fresh origination fee are deducted away from or put into brand new mortgage harmony.

Origination has pre-certification of your own debtor, and additionally underwriting, and you can lenders normally charge an origination payment to afford associated will set you back.

Origination Methods and requires

Pre-certification ‘s the first step of your own processes. The mortgage administrator match into the borrower and you will obtains all of the earliest data and you will recommendations per earnings and assets the loan is meant to security.

Up until now, the personal loans online Iowa lending company find the type of loan for which anyone qualifies, such as for instance a personal bank loan. Fixed-price money keeps a continuous rate of interest for the whole life of one’s mortgage, while varying-speed mortgages (ARMs) have an interest speed one to fluctuates when considering a directory or a thread rate, such Treasury bonds. Crossbreed loans function attract-price areas of one another fixed and varying funds. It frequently start off with a predetermined speed and finally convert so you can a supply.

The fresh borrower gets a list of information had a need to complete the application for the loan in this phase. So it thorough expected files generally boasts the purchase and you will marketing bargain, W-2 models, profit-and-losses comments of individuals who are mind-operating, and you will lender comments. It will include home loan comments in case your mortgage would be to refinance a preexisting mortgage.

The latest borrower fills away a loan application and submits every called for documents. The mortgage administrator following completes new lawfully needed files in order to process the mortgage.